EPFO recently launched “New EPF Withdrawal Forms”, which are called as Form 19 UAN, Form 10C UAN and Form 31 UAN. Now, employees can withdraw EPF without the employer signature.

Important Notice-Now EPFO recently (February, 2017) launched a single form for EPF Withdrawal. Refer the post for the same at “EPF Composite Claim Form -Single form to withdraw EPF without employer“. A Single form is enough for EPF/EPS withdrawal.

Note–

- EPF Grievance Cell -Lodge EPF related complaints online

- How to combine or consolidate multiple EPF Accounts online?

- 4 EPF withdrawal changes effective from Feb 2016

Earlier if you plan to withdraw your EPF balance, the process was too lengthy. However, now the employees, who have their UAN and activated it, may withdraw it by directly submitting to regional EPFO.

What are the conditions to avail this facility?

- You must have UAN number activated.

- You must linked your Aadhaar number with UAN.

- You must provided your Bank details with UAN.

- You KYC have been verified by your employer using digital signatures.

If you are meeting above four conditions, then you can withdraw EPF without the signature of your employer.

What are the facilities provided?

Using “New EPF Withdrawal Forms”, you can do the following activity.

- Withdraw your EPF or apply for final settlement.

- Withdraw your EPS benefit.

- Make partial withdrawal, loan, or advance.

This “New EPF Withdrawal Forms” are easy to fill, as they require your basic data. You have to fill it and submit the same in regional EPFO Office directly. You don’t need your employer signature for the same.

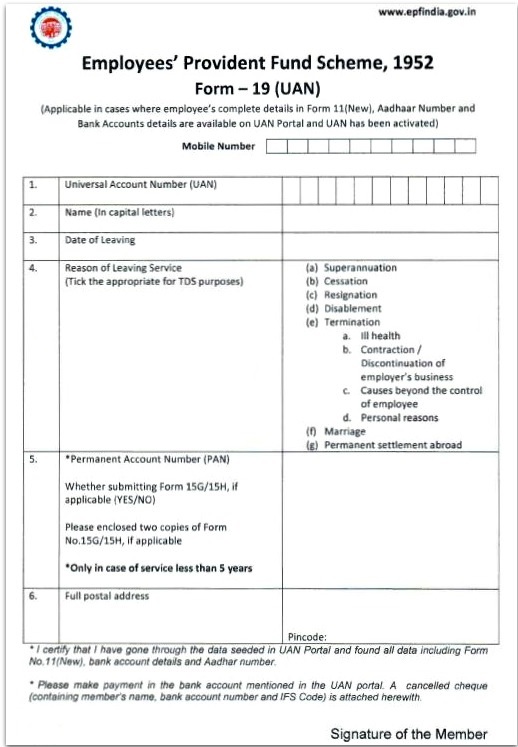

New Form 19 (UAN)

Use this form to withdraw EPF amount when you quit your job due to retirement, resignation, disablement, termination, marriage, or permanent settlement abroad. The few conditions for submitting this form are as below.

- If you are discharged from the service on receiving the compensation under the Industrial Dispute Act, 1947 or resigned from the job, but not employed in a company where EPFO not applicable, then you have to apply for EPF withdrawal only after two months of waiting period. Along with that, you have to declare about non-employment under any organization where you are having another EPF Account.

- If you are employed again in a new company where the employer falls under EPFO act, then you have to submit for TRANSFER only.

You notice that filling this form is so simple. You have to provide the below details.

- Your mobile number, which is linked with UAN.

- UAN number.

- Your name as it appears in UAN.

- Date of leaving the job.

- Provide reasons for leaving the job (Options are already available in the form).

- PAN Number (Only when your service is less than 5 years).

- Check your eligibility for submitting Form 15G or Form 15H (Only when your service is less than 5 years). Do remember that you are eligible to submit Form 15G or Form 15H only when your income is less than the basic exemption limit (For current year it is Rs.2, 50,000). Read my earlier post on the same “EPF Withdrawal Taxation-New TDS (Tax Deducted at Source) Rules“

- If you are eligible for submitting Form 15G or Form 15H, then submit it in two copies.

- Provide your full address details.

- Finally, sign in the space provided for.

- Submit this duly filled form to regional EPFO (Also, attach one cancelled cheque, which contains your name, bank account number, and IFSC code).

- Based on few cases, you have to submit doctor certificate if you are resigning due to permanent and total incapacity due to bodily or mental infirmity, copy of Visa, Passport Journey Ticket if you are migrating from India for permanent settlement abroad and offer of appointment letter and copy of Visa, Passport Journey Ticket in case of taking up employment abroad.

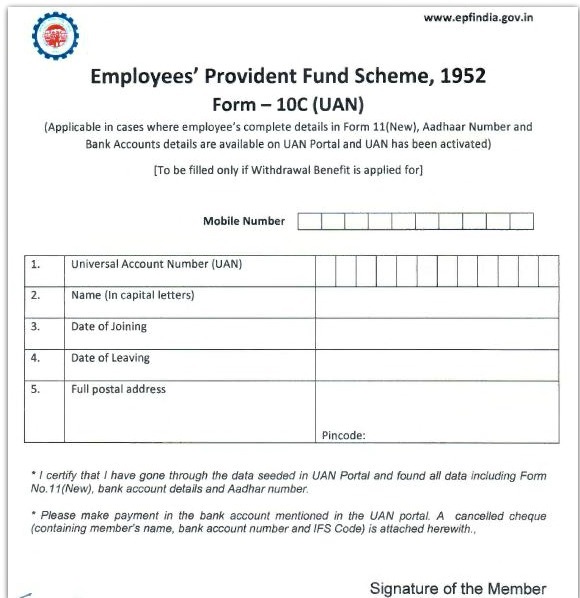

New Form 10C (UAN)

Use this form to claim the EPS amount (Employee Pension Scheme) along with Form 19 (UAN). However, there are certain conditions to use this form and are explained below.

- If you left the job before the completion of 10 years of service;

- If you have attained the age of 58 years before completion of 10 years of service whether in service or left the service.

- If you have completed 10 years of service on the date of leaving your job, but not attained the age of 50 years on the date of filling this form.

- If you attained the age of 50 years, but not 58 years and not willing to go for reduced pension.

- Family member/nominee or legal heir of the employee who died after 58 years age, but had not completed 10 years of eligible service.

No more headaches to fill this form. You have to provide the following details.

- Your mobile number, which is linked with UAN.

- Your UAN number.

- Your name as it appears in UAN.

- Date of joining the current organization.

- Date of leaving the current organization.

- Full postal address of your residence.

- Finally, sign in the space provided for.

- Submit this duly filled form to regional EPFO (Also, attach one cancelled cheque which contains your name, bank account number and IFSC code).

You can read more about the Employee Pension Scheme or EPS in my earlier post “The complete guide to Employee Pension Scheme (EPS) 1995“.

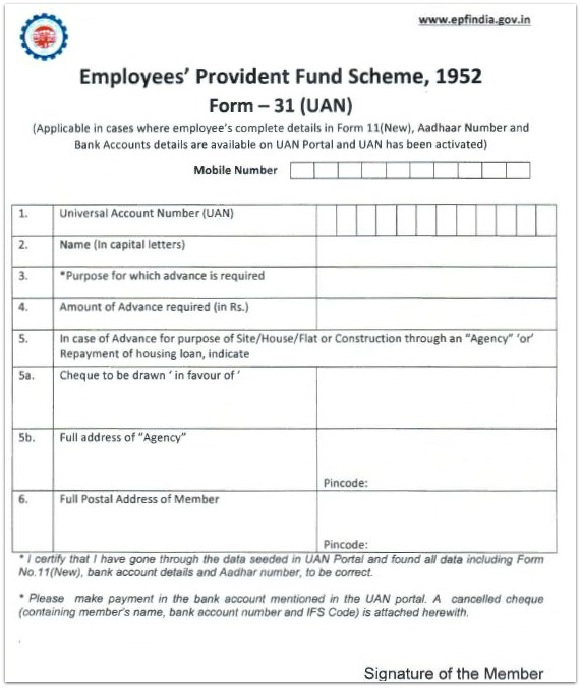

New Form 31 (UAN)

Use this form to avail advances or withdrawal. You can the detailed conditions and eligibility of advance and withdrawal from EPFO in my earlier post “All about EPF (Employee Provident Fund) advance withdrawal“.

Note-Henceforth, employer attestation is not required on Form 31(UAN) (EPFO Circular dated 4th August, 2016).

This is again a simple format and you have to provide details as below.

- Your mobile number which is linked with UAN.

- Your UAN number.

- Your complete name as it appears in UAN.

- Reasons for availing advance or withdrawal.

- Mention the advance or withdrawal amount required.

- In case advance or withdrawal is for the purpose of Site/House/Flat or Construction through a home loan, then the name of the bank to whom you want to pay this advance or withdrawal and full address of a branch.

- Provide your full postal address.

- Finally, sign in the space provided for.

- Submit this duly filled form to regional EPFO (Also, attach one cancelled cheque which contains your name, bank account number and IFSC code). Provide cancelled cheque only the reason is NOT for the purpose of Site/House/Flat or Construction through a home loan.

Please remember that these “New EPF Withdrawal Forms” must be used only when you have UAN and above few conditions met.

What if your Aadhaar and Bank not linked, and your KYC was not verified by an employer?

Nothing to worry, you have to fill the regular Form 19, Form 10C or Form 31 and submit it to regional EPFO. However, in case of withdrawal if your last employer not co-operating with you for withdrawal, then you can follow the below process.

- Fill Form 19 (EPF withdrawal) and Form 10C (EPS Withdrawal). Don’t use these “New EPF Withdrawal Forms”.

- Get attested by anyone of-Manager of a bank (PSU preferred or where you have a savings account), By any gazetted officer or Magistrate / Post / Sub Post Master / Notary.

- Write a letter to regional EPFO stating the reason for not getting attestation from an employer.

- Send the filled form to regional EPFO along with cancelled cheque.

Hope this information will be helpful for all. The complete new instruction is available in “EPFO Circular“